Orlando Real Estate Market Report

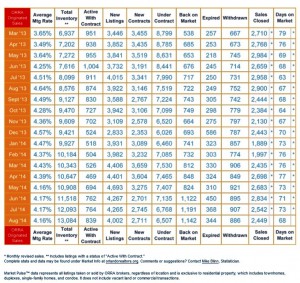

Orlando’s overall home sales declined 16 percent in August 2014 while the area’s median price continued its upward trend, albeit at a slower pace. The overall median price for August is $165,000, a 6.45 percent increase over August 2013 and a 3.48 percent decrease compared to last month.

Orlando’s overall median price has now recorded year-to-year gains for 38 consecutive months and has risen 42.86 percent since July 2011.

Short sales experienced the greatest jump in median price increase in August, coming in at 25.98 percent higher than in August 2013. The median for normal sales increased 5.56 percent, while that for foreclosures increased 9.00 percent.

The median price of single-family homes increased 6.05 percent when compared to August of last year, and the median price of condos increased 1.30 percent.

Members of ORRA participated in the sales of 2,449 homes (all home types and all sale types combined) that closed in August 2014, a decrease of 15.55 percent compared to August 2013 and a decrease of 3.66 percent compared to July 2014.

Szerencses says the decline in sales can be partly explained by a lag between gains in median family income and gains in median home price. “In addition, the first-time homebuyers who are so crucial to the market are still struggling with competition from cash buyers, plus difficulties in saving a down payment and in access to financing.”

Closing of foreclosures in Orlando increased by 30.10 percent in when compared to August 2013. “Normal” home sales in Orlando decreased by 14.25 percent when compared to August 2013 and made up 67.09 percent of the sales pie. Closings of short sales decreased by 64.93 percent.

Single-family home sales decreased 13.12 percent in August 2014 compared to August 2013, while condo sales decreased 16.41 percent. Compared to last month, single-family home sales decreased 5.98 percent and condo sales increased 6.43 percent.

Homes of all types spent an average of 68 days on the market before coming under contract in August 2014, and the average home sold for 96.82 percent of its listing price. In August 2013 those numbers were 67 days and 96.95 percent, respectively.

The average interest rate paid by Orlando homebuyers in August – 4.16 percent – decreased a fraction from July’s 4.17 percent. In August of last year, homebuyers paid an average interest rate of 4.64 percent.

Pending sales – those under contract and awaiting closing – are currently at 6,507. The number of pending sales in August 2014 is 13.46 percent lower than it was in August 2013 (7,519), and 3.86 percent lower than it was in July 2014 (6,768).

Short sales made up 34.44 percent of pending sales in August 2014. Normal properties accounted for 41.68 percent of pendings, while bank-owned properties accounted for 23.88 percent.

The number of existing homes (all sales types and all home types combined) that were available for purchase in August is 52.57 percent above that of August 2013 and now rests at 13,084. Inventory increased in number by 991 properties over last month.

The inventory of foreclosure sales increased by 86.39 percent in August 2014 compared to August 2013. The inventory of normal sales and short sales increased by 56.81 percent and 6.65 percent respectively.

The inventory of single-family homes is up by up by 55.25 percent when compared to August of 2013, while condo inventory is up by 37.23 percent. The inventory of duplexes, townhomes, and villas is up by 56.25 percent.

Current inventory combined with the current pace of sales created a 5.34-month supply of homes in Orlando for August. There was a 2.96-month supply in August 2013 and a 4.76-month supply last month.

Sales of existing homes within the entire Orlando MSA (Lake, Orange, Osceola, and Seminole counties) in August were down by 6.99 percent when compared to August of 2013. Throughout the MSA, 3,209 homes were sold in August 2014 compared with 3,450 in August 2013. To date, MSA sales are down 4.52 percent.

*Each individual county’s monthly sales comparisons are as follows:

• Lake: 6.12 percent above August 2013;

• Orange: 7.39 percent below August 2013;

• Osceola: 17.59 percent below August 2013; and

• Seminole: 6.72 percent below August 2013.